Webpage

Challenges of Achieving Interoperability in Digital Payments

Digital payments have revolutionized how we conduct transactions, offering convenience and efficiency. However, one persistent challenge in the realm of digital payments is interoperability. Interoperability in digital payments refers to the ability of different payment systems to communicate and process transactions. It is essential for seamless and convenient payments across other platforms and providers. A study by Juniper Research predicts that the number of digital wallet users will reach nearly 4 billion, or 50% of the world's population, by 2024. This increase is expected to drive wallet transaction values up by over 80%, exceeding $9 trillion annually. In this blog, let's discuss the challenges hindering interoperability in digital payments and their implications.

Challenges of Achieving Interoperability in Digital Payments

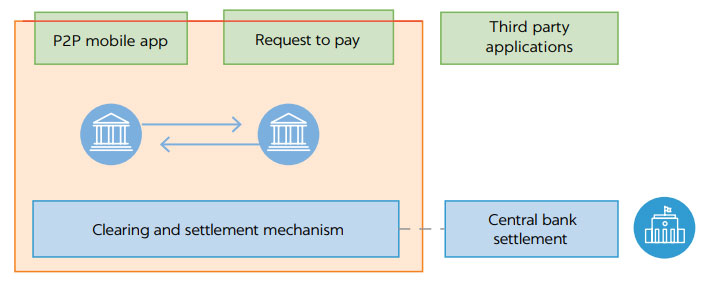

1. Different payment systems tailored to different use cases: The proliferation of separate payment systems is driven by the fact that each system is designed for specific use cases, such as batch-based ACH systems for scheduled payments, debit and credit card systems for merchant payments, wire payments for high-value transactions, and FPS for retail ad hoc payments. While technical interoperability may be possible, the business logic behind interoperability is not always clear. Therefore, any efforts to enhance interoperability should have a clear business objective in mind.

2. Risk of increased fraud: Developing new payment systems allows fraudsters to exploit vulnerabilities. Real-time payment systems, like FPS, can be particularly attractive to fraudsters due to immediate fund transfers. Interoperable systems offer fraud detection and prevention opportunities but also provide fraudsters with new avenues to transfer fraudulent funds. Safeguards must be constantly reevaluated, and fraud-prevention practices must be harmonized to detect and counteract fraudulent activities.

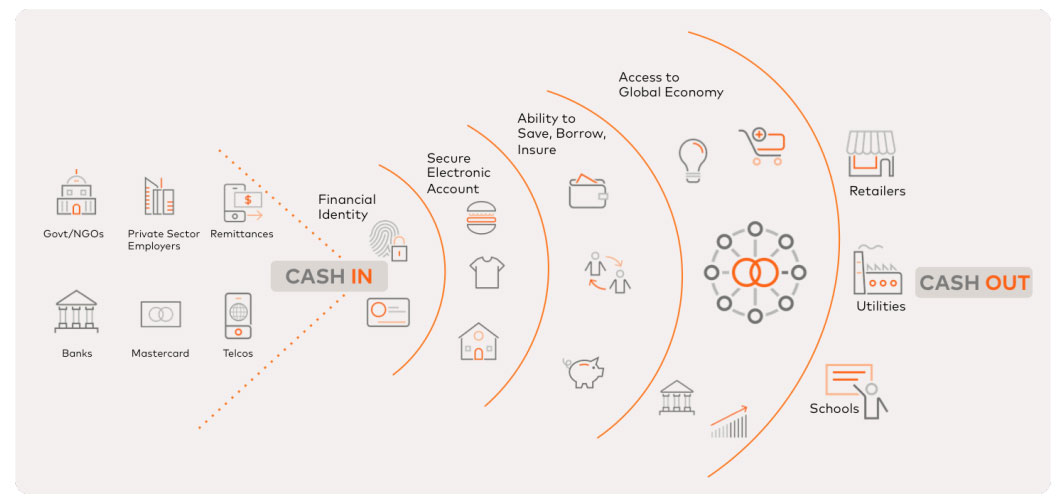

3. New barriers to access: Interoperability in payment systems can broaden access and facilitate innovation, but technical requirements and regulations can hinder participation. Excessive compliance burdens may exclude smaller players, resulting in limited involvement. To address this, interoperability should prioritize the needs of diverse participants, providing affordable pathways for fintech and smaller entities to access payment systems directly and discouraging reliance on indirect access or closed-loop solutions.

4. Reduced resilience in case of system failure: One advantage of non-interoperable payment systems is that operations can still continue through alternative systems if one system fails. However, as payment systems become more interoperable, the risk of system failures affecting other systems increases, potentially leading to systemic risks. This raises the importance of managing and mitigating the impact of system failures to maintain overall payment system resilience.

5. Privacy and Data Protection: Sharing customer data between payment systems increases the risk of unauthorized access and breaches. Strong security measures, explicit customer consent, encryption, and compliance with privacy regulations are necessary. Transparent data governance and harmonization of cross-border data transfer regulations are vital for building trust and protecting customer privacy. Prioritizing privacy ensures a secure environment for seamless and reliable interoperable digital payments.

6. Cultural Differences: Cultural differences, spanning beliefs, values, customs, and behaviors, pose challenges to interoperability, especially in international cooperation and business. Diverse regulations and standards between countries complicate aligning systems, processes, and practices, resulting in conflicts and inefficiencies. Successful collaboration and effective interoperability in a globalized world require a deep understanding of and adeptness in navigating these cultural disparities.

Overcoming Challenges to Achieving Interoperability in Digital Payments

1. Integrate Biometric Authentication: Integrating biometric authentication can enhance the effectiveness of digital payments. This would require consumers to utilize fingerprint scanning or other biometric identification methods when making payments. By doing so, an additional level of security would be introduced to the transaction, guaranteeing that only the authorized user can initiate the payment.

2. Create an Accelerated User Experience: Digital B2B payments possess remarkable potential to enhance cost savings, efficiency, and cash flow for businesses. Streamlining the onboarding process for businesses and providing instant access to funds through virtual cards and mobile wallets will simplify digital payments and encourage wider acceptance. The objective is not solely to simplify transactions but also to establish a rapid, seamless, and secure user experience.

3. Fraud Detection and Prevention: Interoperability can introduce new avenues for fraudulent activities. Robust fraud detection and prevention mechanisms are essential to mitigate these risks. Implementing advanced security measures like multi-factor authentication, real-time monitoring, and AI-based fraud detection algorithms can help identify and prevent fraudulent transactions. Collaboration among payment systems to share threat intelligence can also strengthen the overall security posture.

4. Regulatory Framework: Governments and regulatory bodies play a crucial role in fostering interoperability. They should establish a regulatory framework encouraging collaboration, competition, and innovation while ensuring consumer protection, data privacy, and security. Regulations should balance enabling interoperability and maintaining a level playing field for all participants.

5. Inclusive Approach: Interoperability should prioritize inclusivity and encourage the participation of diverse players, including fintech startups, small businesses, and individuals. Regulatory barriers should be minimized, and technical requirements should be accessible and affordable. Encouraging direct access to payment systems and discouraging closed-loop solutions can foster competition and innovation.

6. Continuous Monitoring and Resilience: As payment systems become more interconnected, monitoring their performance and resilience is crucial. Implementing robust monitoring systems and establishing contingency plans for system failures can mitigate potential risks. Regular audits, testing, and incident response drills should be conducted to identify vulnerabilities and ensure timely response and recovery in case of failures.

Conclusion

In conclusion, achieving interoperability in digital payments poses challenges that need to be addressed. Clear business objectives and technical standards are required to overcome the proliferation of payment systems tailored to specific use cases. Effective fraud prevention measures and accessible regulations are crucial to protect users and encourage participation. System resilience and data privacy must be prioritized to maintain trust. Additionally, promoting inclusivity and fostering international collaboration is essential. By integrating biometric authentication, enhancing user experiences, and establishing a favorable regulatory framework, we can overcome these obstacles and fully harness the advantages of seamless digital payments.

To understand the challenges in achieving interoperability in digital payments and how firms adapt, we invite you to read our insightful blog on digital disruption in lending. Discover how companies are navigating these challenges and staying ahead of the curve.

For expert guidance on tackling the challenges of achieving interoperability in digital payments, please get in touch with us.