Webpage

Digital Disruption in Lending: How Firms are Adapting to Stay Ahead of the Curve

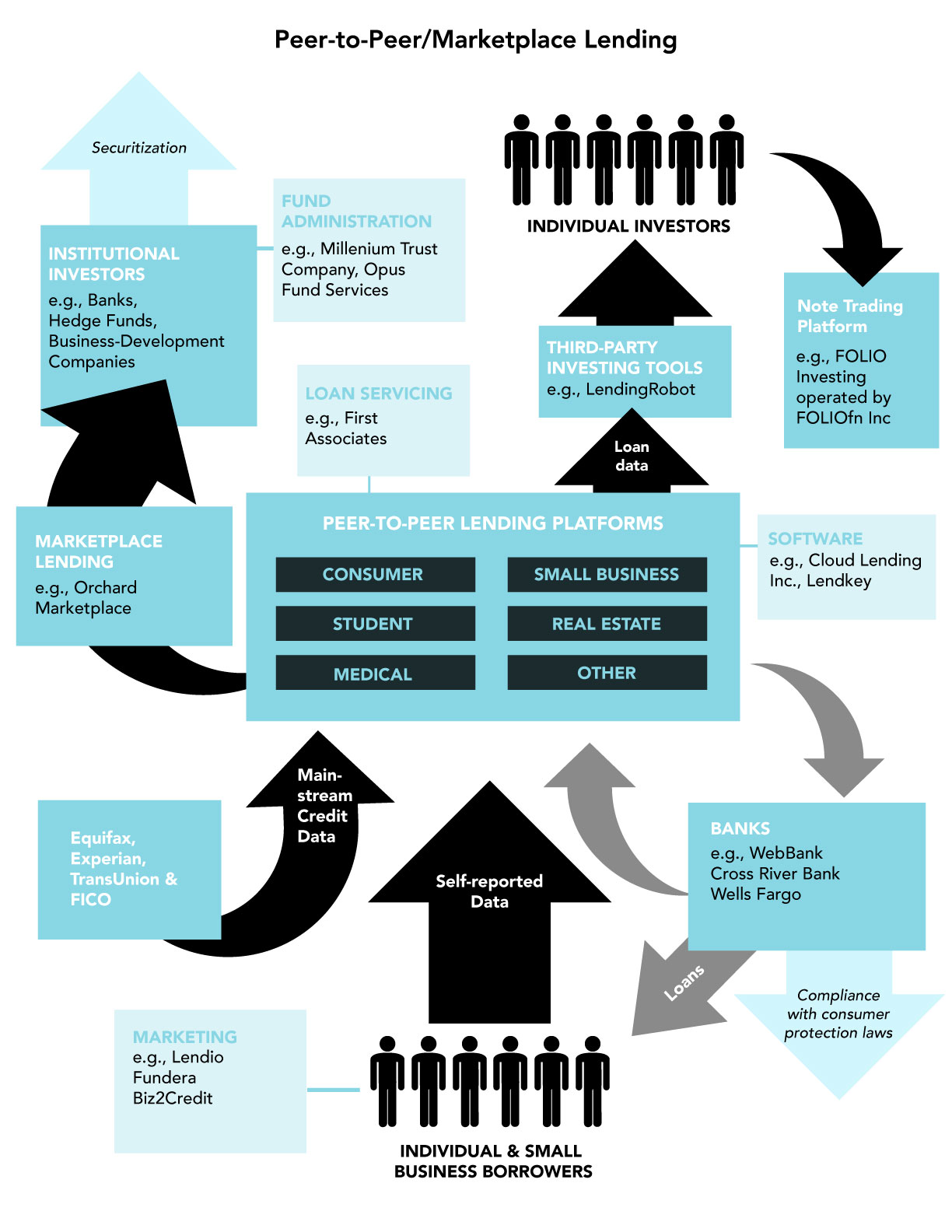

In the age of digital disruption, few industries have remained untouched, and lending is no exception. Digital transformation has significantly changed lending models, operations, and accessibility. The emergence of peer-to-peer lending and crowdfunding has offered borrowers alternative funding sources, while digital tools have enhanced the efficiency and speed of lending. According to MarketsandMarkets, the global digital lending market is expected to grow to a staggering $20.5 billion by 2026 in terms of revenue at a CAGR of 13.8%.

Digital disruption in lending has brought numerous benefits to both borrowers and lenders. At the same time, it has also raised concerns about regulation and risk, particularly in the case of P2P lending. Nonetheless, the future of lending looks promising, with latest technologies and digital platforms continuing to drive innovation and change in the industry. McKinsey's study suggests that by implementing specific strategies, businesses can achieve faster credit decisions, improved customer experience, 40% lower costs, and a more secure risk profile. Here are some of the main advantages:

1. Increased Accessibility

Digital disruption has significantly increased the accessibility of credit to previously underserved borrowers who were once denied credit due to a lack of credit history or low scores. It has made the lending process faster & more convenient and opened up new opportunities for innovation and growth in the financial sector. Alternative data sources like social media and mobile phone usage have made it possible for digital lenders to assess creditworthiness accurately and efficiently.

2. Faster Approval Times

Digital lenders can approve loans in minutes, compared to traditional lenders, who may take days or even weeks to process loan applications. This is because digital lenders use algorithms and automated systems to assess credit risk and make lending decisions, which speeds up the approval process. Faster approval times mean borrowers can access funds quickly, which is particularly important in emergencies.

3. Lower Interest Rates

Digital lending platforms frequently provide more favorable interest rates compared to conventional lending institutions. These lower interest rates translate into significant cost savings for borrowers over the entire duration of the loan. Digital lenders enjoy reduced overhead costs, as they do not require physical office spaces or as many staff, which helps to keep their expenses down. They also use technology to streamline their processes, which reduces administrative costs and enhances efficiency.

4. Personalized Lending

Digital lenders offer personalized lending solutions to borrowers, enabling them to access loan packages that meet their particular requirements. Borrowers can access credit tailored to their specific circumstances rather than being offered a one-size-fits-all solution. Digital lenders can analyze borrowers' financial history, spending patterns, and other factors to create customized loan packages.

5. Improved Customer Experience

Digital lenders provide a seamless and convenient customer experience. Borrowers can easily apply for loans, track their application status, and make payments via an easy-to-use website or mobile app. It means that borrowers can manage their loans on the go and do not require to visit a physical branch to access financial services. This improved customer experience helps to build trust and loyalty among customers.

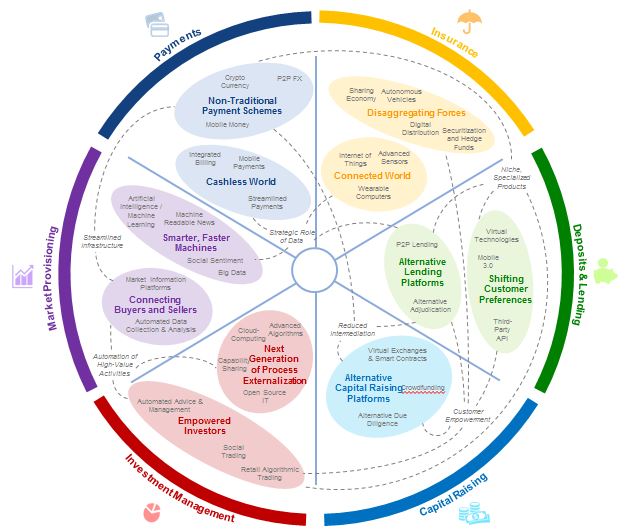

Key Trends and Technologies Related to Digital Disruption in Lending

1. Artificial Intelligence and Machine Learning

AI has transformed the banking industry by streamlining customer service, enabling 24/7 mobile banking access, and enhancing security measures to prevent fraud. This powerful technology helps financial institutions make informed lending decisions and manage risks effectively. Furthermore, AI plays a foundational role in driving the adoption of other digital technologies, such as big data analytics, voice interfaces, and robotic process automation, setting the stage for a revolutionary era in banking.

2. Cloud Computing

Cloud technology has transformed how banks operate, allowing for the aggregation of data and software in specialized third-party locations. It has significant implications for the bank value chain, reducing costs and increasing efficiency. By leveraging cloud technology, banks can optimize their operations and increase their competitiveness in the market. Additionally, smaller firms can benefit from the economies of scale that cloud companies specializing in data storage are able to provide.

3. Blockchain

Blockchain technology is revolutionizing the banking industry by providing faster, more secure, and more efficient transactions, reducing costs, and improving data quality. Smart contracts reduce the need for intermediaries, enabling near real-time settlements, while shared ledgers provide secure transactional information, minimizing fraudulent activity and eliminating discrepancies in data. Blockchain technology significantly benefits the banking industry, transforming transactions and providing greater security and customer satisfaction.

4. Data Analytics

Lenders can create personalized lending products and services that meet individual customer requirements by leveraging data analytics. This technology also helps lenders recognize trends and patterns to enhance credit risk assessment and lending decisions. With data analytics, lenders can make informed decisions that improve their profitability, customer experience, and overall competitiveness in the market.

5. No-Code Development

Low-code/No-code development platforms have become necessary for lenders, allowing them to build and deploy applications quickly and instantly. These platforms provide a user-friendly interface that enables non-technical users to create and tailor applications without writing complex code. It can help lenders accelerate their digital transformation efforts, bring new products to market faster, and streamline their operations. With low-code/no-code (LCNC) development platforms, lenders can use technology without investing in expensive IT infrastructure or hiring additional technical staff.

Conclusion

Digital disruption has transformed the lending industry by providing faster, more convenient, and accessible loan services to consumers. It has also enabled lenders to reduce costs and increase efficiency. Overall, digital lending is a significant advancement that benefits both borrowers and lenders. However, traditional lenders must adapt to remain competitive, and new entrants must overcome regulatory hurdles to succeed.

Intelliswift's expertise lies in providing advanced technology solutions to banks and financial businesses. We specialize in digital banking, cybersecurity, and core banking systems that increase revenue, improve security, and automate processes for better customer engagement. Our tailored solutions use the latest technologies and platforms for seamless digital banking capabilities, and we provide AI-based offerings to help build strong customer relationships while staying compliant.

Contact us to learn more about our expertise in delivering advanced technology solutions that will help you stay competitive and future-proof your business in the era of digital disruption in lending.